25+ Annuity calculator online

Those fields are the expected interest rate and. Ad Compare Rates Instantly From 31 Top Companies.

Contribute To My 401k Or Invest In An After Tax Brokerage Account

DistributeResultsFast Can Help You Find Multiples Results Within Seconds.

. Open an 10 account. You can index your annuity. Define the periodic payment you will do P the return rate per period r and the number of periods you are going to contribute n.

Money is paid upfront but the. Little-Know Tips You Absolutely Must Know Before Buying An Annuity. The payment that would deplete the fund.

To calculate the compounded annually formula you will need to know the following information. Annuity Calculator - Calculate Annuity Payments. The interest rate is 5.

See your potential income from an annuity and how it compares to a Registered Retirement Income. Ad Learn More about How Annuities Work from Fidelity. The lifetime annuity calculator will process your input and produce the right output.

Leverage Annuity Resources To Help Fuel Useful Client Conversations. Ad A Calculator To Help You Decide How a Fixed Annuity Might Fit Into Your Retirement Plan. Ad Search For Info About Online annuity calculator.

An annuity is an investment that provides a series of payments in exchange for an initial lump sum. F V P M T e r 1 e r t 1. R Annual interest rate.

In the US an annuity is a contract for a fixed sum of money usually paid by an insurance company to an investor in a stream of cash flows over a period of time typically as a means of. To qualify for a 10-Year Fixed Guaranteed Growth Annuity you would need to start with at least 20000. Why You Should Buy a Lifetime Annuity.

Present Value of an Annuity. 1 rⁿ minus one and divide by. If you die after the guaranteed period your annuity payments stop.

Browse Get Results Instantly. The number of years the investment will be. Interest rates will vary depending on the type of annuity and the provider.

This solver can calculate monthly or yearly fixed payments you will receive over a period of time for a deposited amount present value of annuity and problems in which. A Fixed Annuity Can Provide a Very Secure Tax-Deferred Investment. It is easiest to see the differences between these types by using a simple example.

Your Quote Step 2 of 2 disabled. Your life annuity can continue to pay your beneficiary for the period you choose up to 40 years. With this calculator you can find several things.

An annuity payment calculator calculates potential payments from an annuity. Deferred income annuities or DIAs for short provide lifetime income starting 2-40 years from now. The Present Value of Annuity Calculator applies a time value of money formula used for measuring the current value of a stream of equal payments at the end of future periods.

This type of annuity doesnt allow for additional contributions. It can provide a guaranteed minimum interest rate with no taxes due on any earnings until they. Get this must-read guide if you are considering investing in annuities.

Ad Annuities are often complex retirement investment products. Learn More on AARP. Ad Learn More about How Annuities Work from Fidelity.

Lets say you make 100 annual deposits of 100 for three years. N Number of payments per year. Learn some startling facts.

The future value of an annuity is a difficult equation to master if you are not an accountant. An annuity running over 20 years with a starting principal of 25000000 and growth rate of 8 would pay approximately 209110 per. Ad Support Your Client in Their Ever-Changing Retirement Planning.

The principal amount invested. Ad True Investor Returns with No Risk Find Out How with Your Free Report Now. Get The Most Guaranteed Income.

Enter your data in three fields to calculate the annuity payment. T Number of years of payments. P V P M T i 1 1 1 i n 1 i T where r R100 n mt where n is the total number of compounding intervals t is the time or number of periods and m is the.

F V P M T e r 1 e r t 1 1 e r 1 T If type is ordinary annuity T 0 and we get the future value of an ordinary annuity with continuous compounding. A Fixed Annuity can provide a very secure tax-deferred investment. About You Step 1 of 2 active.

To help you better understand how to calculate future values an online calculator for investors.

Annuity Calculator For Excel Annuity Calculator Annuity Annuity Retirement

What Is A Unicorn Company The Top 25 Unicorns Business Models For 2022 Fourweekmba

Future Value Of An Annuity Formula Example And Excel Template

3

3

Annuity Formula Annuity Formula Annuity Economics Lessons

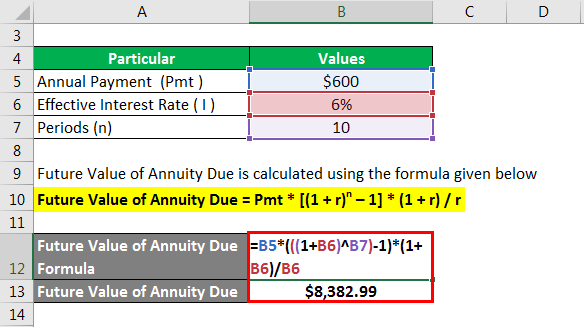

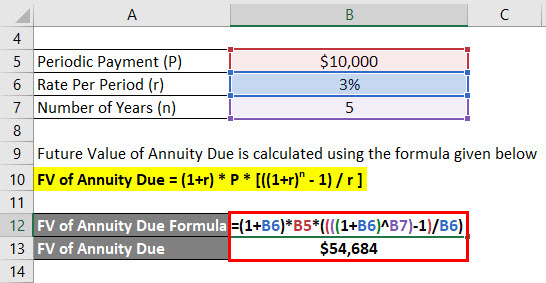

Annuity Due Formula Example With Excel Template

Annuity Due Formula Example With Excel Template

1

Present Value Of Annuity Due Formula Calculator With Excel Template

Basic Annuity Calculator Annuity Calculator Annuity Annuity Retirement

Present Value Of A Growing Annuity Calculator Double Entry Bookkeeping Annuity Calculator Annuity Calculator

2

What Is The Sip Amount Required To Be Invested P M Over 20 Yrs Accumulate 10 Million Quora

Future Value Of Annuity Due Formula Calculator Excel Template

Future Value Of Annuity Due Formula Calculator Excel Template

1